Why Japan Inc. has not written off Australian LNG

Over the past year, the Australian LNG sector has been hit with hawkish revisions to the Australian Domestic Gas Security Mechanism (ADGSM) and the Safeguard Mechanism, and indigenous legal challenges to already sanctioned developments at Barossa, and more recently, Scarborough. As legacy investors in Australian LNG, dependent on Australia for over 40% of their LNG imports, Japanese companies have voiced their concerns in uncharacteristically direct terms and engaged diplomatic channels to ensure supply security.

As multi-billion-dollar, multi-decade endeavors, LNG investments require very stable policy and contract sanctity. This commentary will examine the factors that keep Australia attractive to Japanese investors. But they will now need assurances that Japanese investments, and by extension, Japanese energy security, is not at risk on Australia’s account.

Energy security through equity LNG

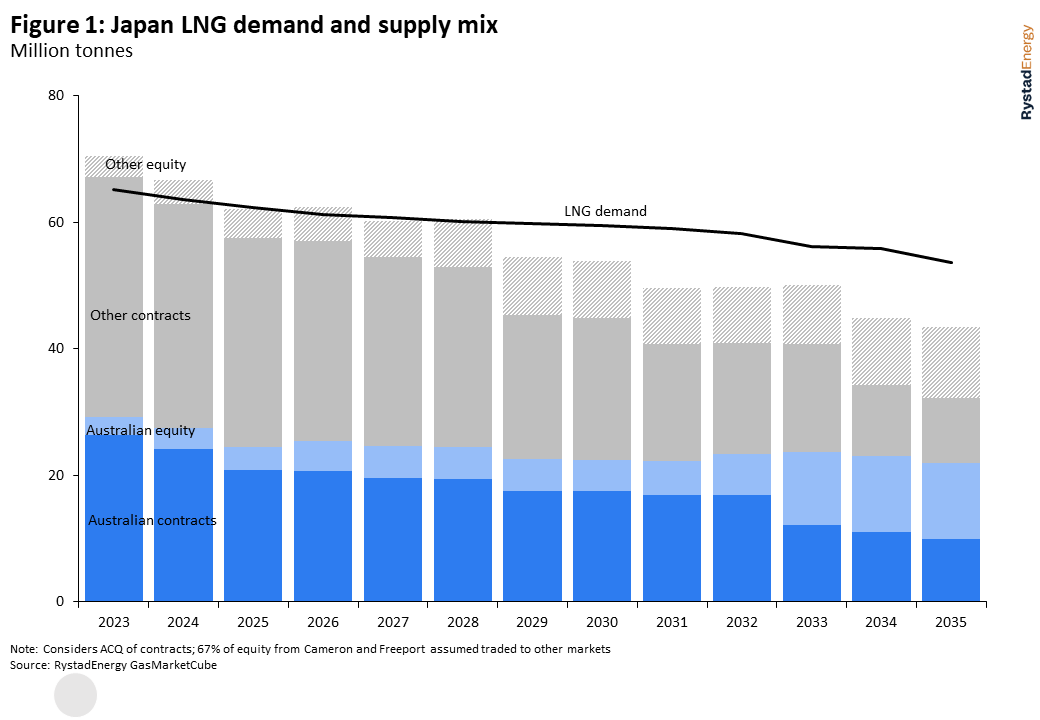

Japan’s sixth energy plan (2021) directs Japanese companies to raise the proportion of equity oil and gas resources from 34.7% in Financial Year 2019 to more than 50% by 2030 and more than 60% by 2040. Australia is one of few LNG producers where this commercial structure exists, with project owners independently developing their upstream resources and independently marketing their share of the LNG as part of a jointly owned project, giving them better control of their supply chain. In fact, Gorgon was the first ever project to be sanctioned on this lifting structure. LNG Japan’s investment in a 10% stake in Scarborough also includes an equity offtake of 0.8 million tonnes per annum (Mtpa), in addition to a separate, 0.9 Mtpa Heads of Agreement (HoA). The equity structure also is also compatible with Japan’s long-term demand uncertainty with decarbonisation measures and the return of nuclear power – off-takers can take volumes to Japan for as long as necessary and divert them to other markets after that. Per Figure 1, Japanese LNG demand will decline from 73 million tonnes (Mt) in 2022 to around 54 Mt in 2035, but their contract profile declines more steeply, indicating the need for additional volume likely through a combination of contracts and equity volumes.

Per Figure 1, Japanese LNG demand will decline from 73 million tonnes (Mt) in 2022 to around 54 Mt in 2035, but their contract profile declines more steeply, indicating the need for additional volume likely through a combination of contracts and equity volumes.

Amidst the recent rapid progress of US LNG projects, Australia’s location within the Asia-Pacific basin also supports the regional energy security narrative. A Gladstone-Tokyo voyage takes around 9 days for an LNG carrier at 19 knots, but a USGC – Tokyo voyage could take 25 days with waiting at the Panama Canal, or with rising congestion there could take up to 35 days through the Cape of Good Hope. Ergo, Australian projects are better placed to respond to an unexpected demand surge, which may become common as an increasing proportion of variable renewable sources in the power mix increases the variability of gas consumption for power.

High transparency regime

Australia’s governance and disclosure requirements make it a high transparency and accountability regime that Japan Inc. is well versed with, as a legacy investor in multiple industries. While this can be perceived as burdensome, Australian LNG is also more likely to withstand long-term scrutiny on emissions accounting, and it helps that off-takers have better transparency of the emissions of their value chain. Public awareness of emissions reporting can also drive meaningful emissions mitigation action (such as CCUS) that may not have occurred in more opaque regimes. In the wake of the invasion of Ukraine, (and more recently, the Israel-Hamas conflict), this is an increasingly geopolitically polarised era with a renewed focus on energy security. Countries may prefer trading with more like-minded partners.

For Japan – energy security remains paramount, and Australian LNG plays an arguably more critical role to them than even Russian LNG (comprising 9% of Japan’s LNG imports), which Japanese companies have stayed invested in.

Positioned for growing energy demand

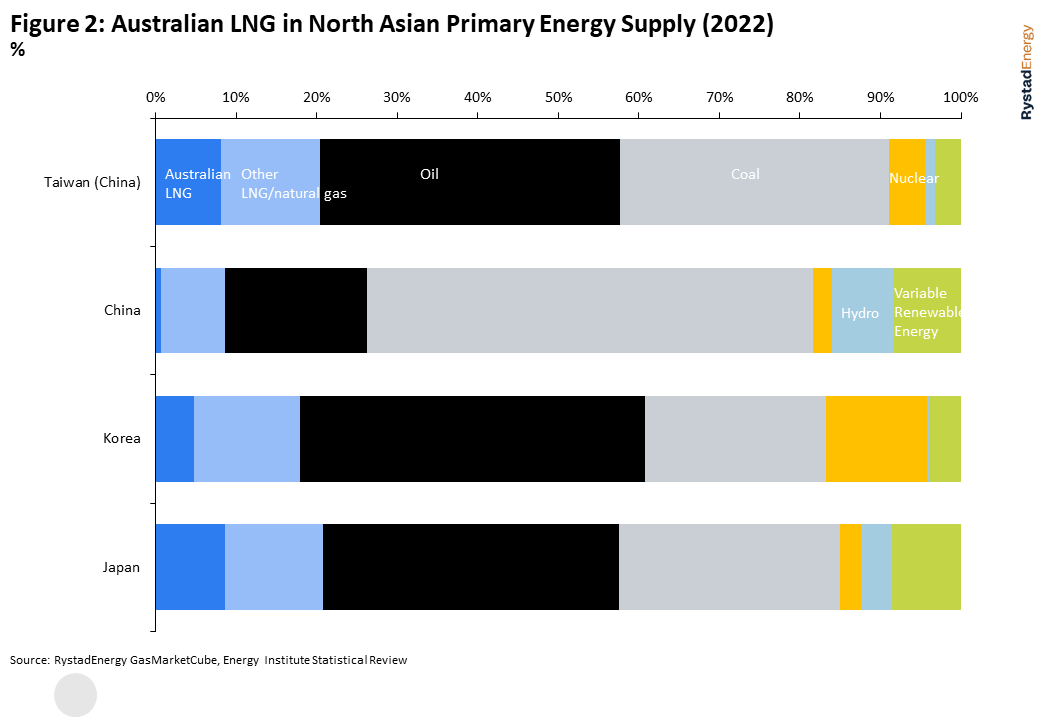

Over the long-term, we see two roles for Australian LNG in the regional energy system. For OECD Asia-Pacific and legacy LNG customers, Australian LNG remains a pillar of their energy security for the foreseeable future (see Figure 2). However, even as their energy transition progresses, geographical proximity and emissions transparency and mitigation through CCUS could extend the longevity of Australian LNG in their energy mixes. Proximity allows for a more regionalised supply chain, with lower transportation emissions, and as discussed above, better flexibility and energy security. Australia is also well positioned for future LNG demand growth in the Asia-Pacific. In our base energy transition scenario (with a global temperature increase of 1.9 degrees Celsius by 2100), LNG demand in Asia (ex-Middle East) continues to grow until it peaks at 500 Mtpa in 2040.

Australia is also well positioned for future LNG demand growth in the Asia-Pacific. In our base energy transition scenario (with a global temperature increase of 1.9 degrees Celsius by 2100), LNG demand in Asia (ex-Middle East) continues to grow until it peaks at 500 Mtpa in 2040.

As OECD countries develop future energy sources such as energy metals or hydrogen in Australia, their offtake of Australian LNG could support demand in South and Southeast Asia where LNG is still a solution. Energy demand in these regions is still growing, and any share relinquished by Australian LNG could be taken by any combination of less transparent regimes and more polluting fuels.

The Australia-Japan relationship is one for the ages. Japan of all countries can appreciate the importance of domestic energy security. Despite the regulatory interventions of the past year, we believe they will both work to find common ground not only in LNG trade but also in future energy sources.

Energy Monthly

Get a different perspective on energy with our monthly newsletter.

Up next

.png)

Creating clarity during the energy transition.

Get a different perspective on energy with our monthly newsletter.

All rights reserved Energy Insights Pty Ltd