2025 in review: Momentum on paper, friction in practice

By the end of 2025, Australia’s energy transition looked more defined on paper than it did in steel, silicon, and substations. The year delivered clarity on long-term ambition - but also reinforced how exposed the transition remains to delivery risk, infrastructure lag, and policy sequencing failures.

The re-election of the Albanese Labor Government removed near-term political uncertainty around climate ambition - especially around nuclear generation. Yet the system-level outcomes of 2025 revealed a widening gap between targets, plans, and implementation.

Emissions: Marginal progress against ambitious trajectories

Australia’s national emissions declined by 2.2% in FY2024–25, a fall of 9.9 million tonnes of CO₂-e following several years of near-flat outcomes. While directionally positive, this pace remains inconsistent with the steep abatement curve required to meet legislated targets.

The Australian Government announced its 2035 emissions reduction target of 62-70% below 2005 levels as recommended by the Climate Change Authority. The announcement provided long-term certainty, but also sharpened scrutiny of near-term delivery.

“This is despite the fact that achieving the 2030 target of a 43% reduction is looking challenging due to a slowness in building renewables’ infrastructure to meet an 82% renewables target,” Tony Wood, Energy Program Director at the Grattan Institute, told Energy Insights.

“Australia’s emissions fell by a very modest 2.2% in the 2024–25 financial year after several years of flatlining… A lot of announcements and reviews, with precious little action on implementation and outcomes.”

Electricity: Renewables growth constrained by system bottlenecks

Renewables continued to dominate new capacity investment in 2025, supported by the Capacity Investment Scheme (CIS) and state-based underwriting mechanisms. Yet the year again exposed the fragility of relying on generation build without commensurate transmission, storage, and system services.

Key constraints included:

- Transmission delays across multiple Renewable Energy Zones (REZs)

- Connection backlogs for both large-scale renewables and storage

- Rising curtailment risk in weak grid locations

- Coal closure uncertainty, complicating dispatch and reliability planning

Importantly, transmission challenges in 2025 were not solely characterised by delay. The year also saw continued reform of transmission governance, financing and access frameworks, particularly within Renewable Energy Zones, as governments and regulators sought to address cost recovery, social licence, and coordination failures. These institutional reforms remain works in progress, but they reflect a growing recognition that transmission delivery is as much a governance challenge as an engineering one.

Figure 1.1 Electricity generation from renewable sources by fuel

Figure 1.1 Electricity generation from renewable sources by fuel

The National Energy Market (NEM) Review final report, released on 16 December 2025, acknowledged that legacy market frameworks are no longer fit for a system dominated by inverter-based resources.

Alongside market reform debates, 2025 saw incremental but meaningful progress on essential system services. Frameworks for system strength, inertia and fast frequency response continued to evolve from ad hoc interventions toward more structured procurement and planning arrangements. While still incomplete, these changes marked a quiet but important transition toward treating system security services as explicit, investable requirements in an inverter-dominated grid.

Networks and consumers: Decentralisation accelerates, coordination lags

At the distribution level, customer energy resources (CER) - rooftop PV, batteries, EVs - continued to scale rapidly. However, coordination between consumers, DNSPs, and market operators remains underdeveloped.

Key challenges evident in 2025:

- Inconsistent export limits and orchestration frameworks

- Limited monetisation pathways for consumer flexibility

- Slow progress on distribution-level visibility and data access

The result is a system increasingly shaped by consumer assets, but still governed by wholesale-centric rules.

At the same time, demand-side reform began to enter mainstream system planning discussions. Operational demand response, flexible load management, and the growing impact of electrification - particularly electric vehicles and electrified heating - increasingly featured in network and market design considerations. While still immature, these developments signalled a shift toward viewing demand not merely as a forecasting challenge, but as a potential system resource in an increasingly decentralised grid.

Gas: unresolved role, unresolved policy

Gas policy remained one of the most contested areas of the transition in 2025. While widely framed as a ‘firming fuel’, its long-term role remains ambiguous amid declining demand forecasts and escalating supply risks on the east coast.

Anticipation grew around the long-flagged Gas Review, expected to address affordability, supply adequacy, and transition alignment. As of year-end, policy certainty remained elusive.

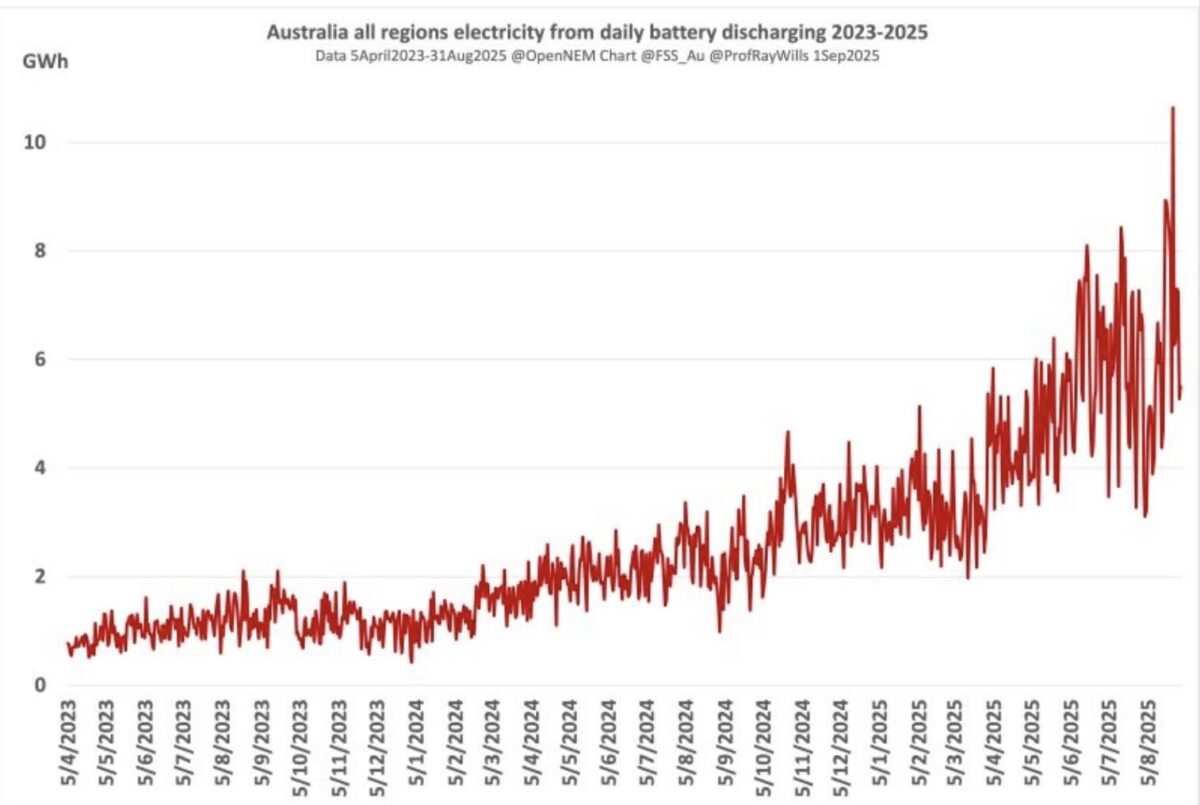

Large-scale batteries

Large-scale batteries also moved decisively from pilot projects to portfolio deployment in 2025. Across NSW, Victoria and Queensland, grid-scale batteries reached multi-gigawatt committed or operational capacity, increasingly providing energy shifting, frequency control ancillary services (FCAS), and reliability support during coal outages and peak demand events.

Figure 1.2 Big batteries rise in Australia

While not yet sufficient to fully offset coal retirements, batteries materially altered dispatch patterns and price formation in several regions, reinforcing their role as core system infrastructure rather than transitional add-ons. The shift toward longer-duration (four-hour and beyond) storage also gathered pace, reflecting growing recognition of the limits of short-duration assets in a coal-exiting system.

Climate risk enters the mainstream

One of the most consequential - if least operationalised - developments of 2025 was the release of Australia’s first National Climate Risk Assessment, alongside the National Net Zero Plan.

Wood commented: “The NZ Plan was severely lacking in clear policies to meet the targets while the Risk Assessment makes for sobering reading.”

2025 in summary

2025 clarified the direction of Australia’s energy transition but highlighted persistent weaknesses in delivery, coordination, and policy sequencing. The foundations are now set. Whether they translate into system-level outcomes depends on what follows.

Energy Monthly

Get a different perspective on energy with our monthly newsletter.

Up next

.png)

Creating clarity during the energy transition.

Get a different perspective on energy with our monthly newsletter.

All rights reserved Energy Insights Pty Ltd